Examine This Report on What Happens If I Leave a Creditor Off My Bankruptcy

In a very Chapter seven situation, you may not be in the position to discharge (wipe out) the debt. Also, if you fall short to listing a secured creditor, like your automobile personal loan, you might lose the property that you choose to put up as collateral for that mortgage. In a very Chapter 13 bankruptcy case, leaving off a creditor could possibly bring about you to get to dismiss your situation and refile it.

A short message, in advance of our meeting Together with the lawyer. I just want to thank you for your assistance and persistence. You have already been incredibly useful And that i enjoy your professionalism and nicely well balanced attitude.

By distributing this kind I comply with the Terms of Use and Privacy Plan and consent to get contacted by Martindale-Nolo and its affiliate marketers, and up to 3 attorneys about this ask for and also to obtaining applicable internet marketing messages by automatic means, text and/or prerecorded messages on the selection delivered. Consent is not needed like a situation of support, Click this link

Specially, once you file for bankruptcy, You need to offer the courtroom which has a whole lot of economic information on official bankruptcy types, such as the names and addresses of the creditors. You will also list all those creditors in a doc called the mailing matrix or maybe the mailing checklist.

In scenarios which can be dismissed with no prejudice, the filer can promptly file a different bankruptcy petition. Most bankruptcy dismissals are without prejudice.

Each posting that we publish has become composed or reviewed by one of our editors, who collectively have around 100 years of knowledge training law. We strive to keep our facts current as legal guidelines transform. Find out more about our editorial requirements. In case you are unsuccessful to record a creditor on your bankruptcy circumstance mailing matrix, you can be triggering your self a foul headache Down the road.

Due to how long Chapter 13 cases can very last mainly because of the More Info repayment approach, reinstatement is commonly Utilized in Chapter 13 scenarios. Such as, you may perhaps pass up a regular payment through 12 months two on the repayment prepare.

In case you end up which has a dismissed bankruptcy case and you continue to choose to declare bankruptcy (and take full advantage of the automatic stay), you usually have the choice of possibly reinstating your bankruptcy case or filing a new one particular.

Pro bono company presents totally free legal help for those who cannot manage legal costs. Here is all the things you want to know about pro bono, which includes How to define a professional bono legal professional.

Obtain a credit home score-builder mortgage. You could consider a credit-builder loan in addition to or in lieu of a secured bank card. Using this type of installment bank loan, the lender will hold the bank loan proceeds—generally between $three hundred their explanation and $1,000—within a independent account while you make payments, which the lender will report back to the credit score bureaus.

This holistic process makes it a lot more most likely that you just'll be approved on your personal loan. Their interest premiums are competitive with other lenders, and 1000s of people have used this platform to get loans in a short time at the time permitted.

Reaffirmation settlement: Underneath Chapter 7 bankruptcy, chances are you'll check my site agree to carry on spending a financial debt that may be discharged during the proceedings.

Our totally free tool has served fourteen,635+ family members file view it now bankruptcy on their own. We're funded by Harvard College and won't ever talk to you for a credit card or payment.

Professional bono attorneys provide no cost lawful solutions to people who won't be able to afford to pay for an attorney. Check out what Advantages you can obtain from retaining a professional bono legal professional, How to define a person and the way to do the job with them.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Jennifer Love Hewitt Then & Now!

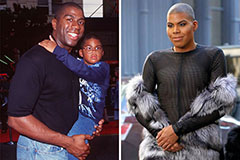

Jennifer Love Hewitt Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!